Higher Borrowing Rates Pushing Some GTA Investors Out of the Market

“Larger proportion of GTA real estate investors say increased lending rates have caused them to consider selling their investment properties, compared to other major urban centres”

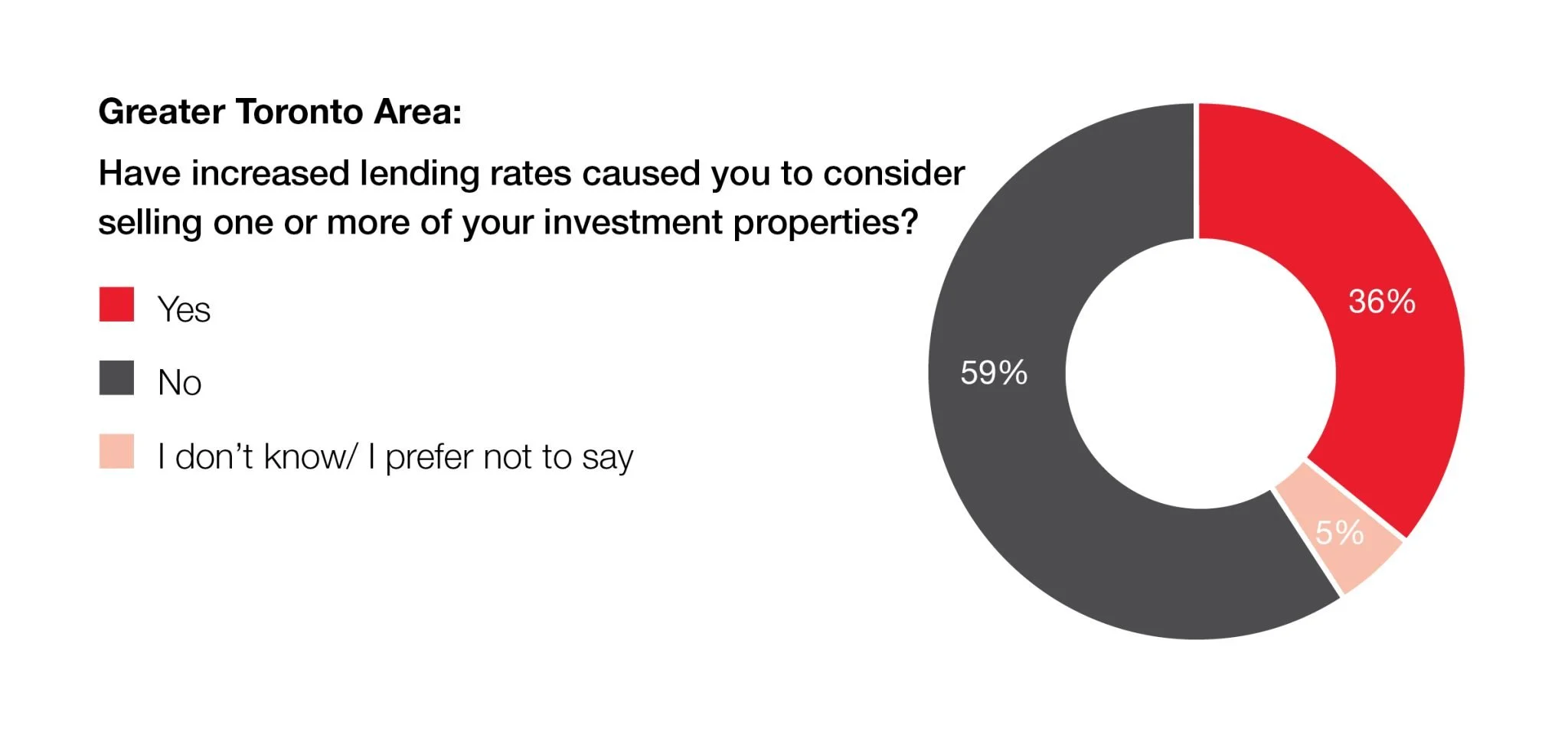

The significant impact of rising home prices and borrowing costs has affected both homeowners and aspiring buyers, including real estate investors. A recent survey conducted revealed that 36% of investors in the Greater Toronto Area (GTA) are considering selling one or more of their investment properties due to increased lending rates. This percentage is higher than the national average of 31% and surpasses the figures reported in the Greater Montreal Area (26%) and Greater Vancouver (28%). Looking ahead, 24% of GTA investors indicated that they are likely to sell one or more of their investment properties within the next two years.

Investors need to be prepared for market downturns. During the pandemic, we observed some first-time investors entering the market when interest rates were at record lows and home prices were starting to rise. However, a year or two later, they are now facing significantly higher borrowing costs, which may result in reduced or neutralized monthly income. Collaborating with a knowledgeable real estate professional who understands the intricacies of investing and can provide insights into the short- and medium-term market outlook can be highly advantageous. Historically, the GTA has been a thriving market for real estate investors, and I anticipate that the region will continue to attract high-quality investors in the future.

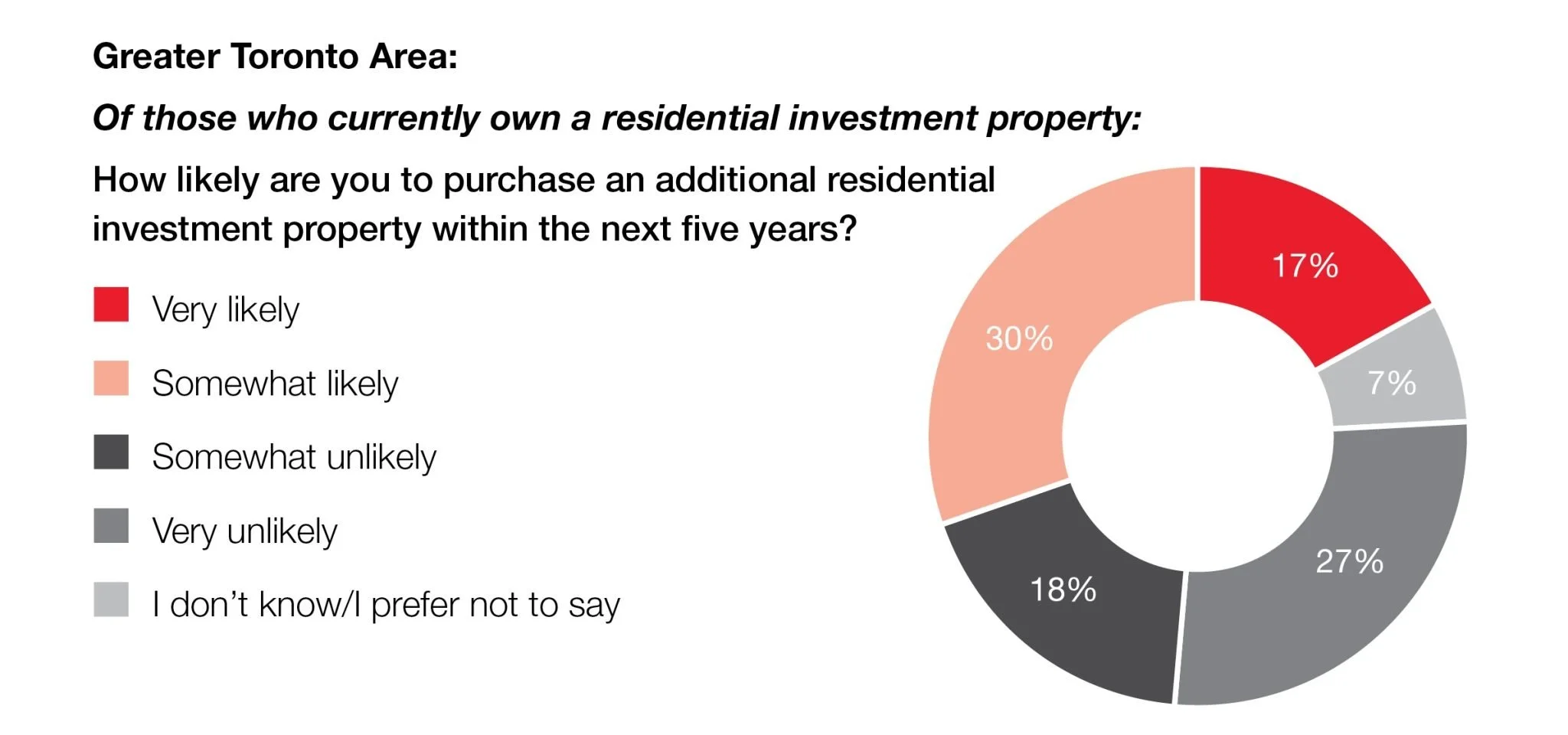

Despite the challenges, some investors in the GTA remain optimistic. Forty-seven percent of them stated that they are likely to purchase an additional residential investment property within the next five years, which is slightly lower than the national average of 51% and the figures reported in the Greater Montreal Area (52%) and Greater Vancouver (54%).

Homeownership is a crucial element of the Canadian dream. While owning a primary residence is a solid investment in itself, many Canadians view real estate investing as a means to achieve financial security. The advantages of this approach include not only the ownership of a tangible asset and the potential for monthly cash flow, but also the possibility of long-term appreciation. Consumers are becoming increasingly knowledgeable about real estate investing, leading to a rise in confidence and interest within the sector. A fast-growing segment of the investor market in the Greater Toronto Area (GTA) consists of savvy millennials who, inspired by income property shows on HGTV, are actively seeking opportunities to build generational wealth.

However, it is important to view real estate as a long-term investment that may require patience during temporary market fluctuations. Collaborating with a knowledgeable real estate professional who understands the intricacies of investing and can provide insights into the short- and medium-term market outlook can prove highly advantageous. Historically, the GTA has been a thriving market for real estate investors, and it is expected to continue attracting quality investors from various locations in the years to come.